Here is a nice article addressing a core component of the fund administrator role: how to calculate a NAV (net asset value). This is useful for fund accountants preparing for roles in NAV calculation in hedge funds and NAV calculation in mutual funds. For more advanced fund accounting training and fund financial reporting training reach out to us-www.getmeupskills.in

WHAT ARE OPEN-ENDED INVESTMENT FUNDS

Open-ended investment funds allow investors invest, or withdraw, funds on a regular basis. Many mutual funds allow investors to do this on a daily basis. In other words, many mutual funds are daily dealing funds. Many hedge funds permit investments and withdrawals monthly. That is, they are monthly dealing funds.

Mutual funds and many hedge funds are unitised. This means that the fund issues shares or units to investors. In order to ascertain the value of a share in the fund, the fund must complete a NAV calculation (net asset valuation). The NAV calculation is a core element in mutual fund accounting and hedge fund accounting.

WHAT IS A NAV

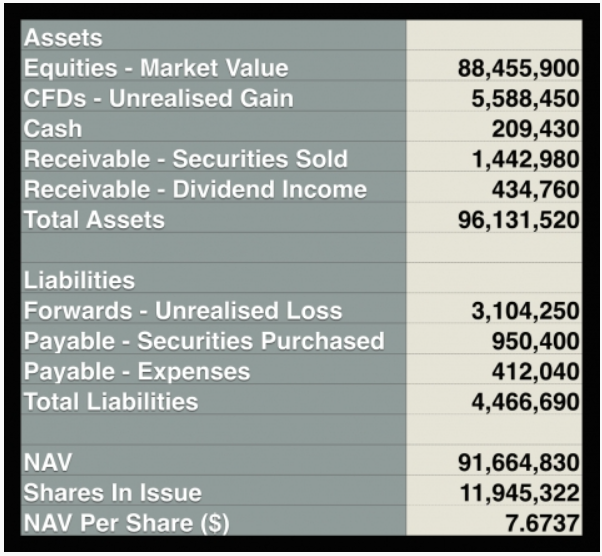

A NAV calculation ascertains the fund value as at a point in time. It is the total assets less total liabilities.

Assets are what the fund owns. This includes receivables.

Liabilities are what the fund owes. This includes payables.

Let’s see what is behind each line item in the NAV calculation.

NAV Calculation

NAV Calculation - Equities

This NAV calculation has been done as at the close of business on 31st August. So the market value of the equity portfolio has been calculated using the closing market prices of 31st August. The fund pricing policy determines the type of price used. It is often the last traded price.

NAV Calculation - CFDs

The unrealised gain on open CFD positions is calculated by comparing the closing prices of the underlying asset on 31st August with the price at which the position was opened or reset.

NAV Calculation - Cash

The cash balance is straightforward. It’s simply the cash sitting in the fund’s cash account at the close of business on the 31st August.

NAV Calculation – Unsettled trades

NAV accounting is done on a trade date basis. This fund sold equities on 30th August and the trades settle on 2nd September. This means the fund will pay the cash on 2nd September and the equities will be received into the fund’s custody account on 2nd September. But because we’re fund accounting on a trade date basis, 30th August is the effective date of the transfer of ownership of the equities.

So? The equities sold on 30th August are NOT included in the market value of the equities in the 31st August NAV. But, the cash that will be received on 2nd September IS included in assets as Receivable for Securities Sold.

Similarly, equities purchased on 30th August are included in the market value of the equities in the 31st August NAV. And the cash that will be paid on 2nd September is included in liabilities as Payable for Securities Purchased.

NAV Calculation – Income Receivable

NAV accounting is done on an accruals basis. So income and expenses are recognised in the period to which they relate. This is often different to the point where the cash is actually received or paid.

Regarding dividend income, the fund includes the income on ex-date. The dividend income receivable in the 31st August NAV will probably be received during September. But because we’re fund accounting on an accruals basis, it is included in the 31st August NAV.

NAV Calculation – Currency Forwards

The unrealised loss on open currency forwards positions is calculated by comparing the closing forward rates on 31st August with the rate at which the position was opened.

NAV Calculation – Expenses Payable

As discussed above, NAV accounting is done on an accruals basis. So expenses are recognised in the period to which they relate. As at 31st August the fund recognises expenses that have been incurred up to that point. The expenses payable amount reflected in the NAV calculation includes, for example, the management fee and the administration fee incurred in respect of the month of August.

NAV Calculation – NAV per share

The total net asset value is € 91,664,830. The number of fund shares in issue as at the 31st August is 11,945,322. So the NAV per share is $7.6737.

NAV Calculation - Partnerships

If the fund is a partnership, no shares or units are issued and the NAV consists of an allocation of fund gains/losses across the partnership capital accounts.

WANT TO LEARN MORE ABOUT FUND ACCOUNTING?

I KNOW THE BASICS. WHAT ELSE CAN I DO?

Check out more advanced online fund accounting courses by clicking on TRAINING at the top of this page. These include fund accounting for corporate actions, currency forwards, CFDs, fixed income securities, performance fees....

Comments